Analysis of FBMKLCI ( the way I look at it )

FBMKLCI

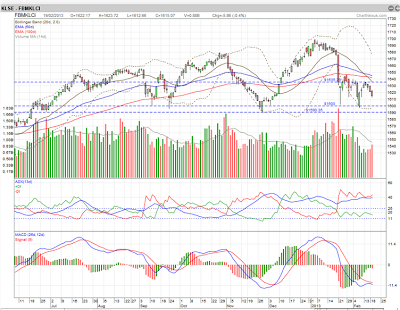

The KLCI closes up for the last 2 days,making it slightly bullish...

I am seeing more bullish days ahead if it can close and maintain above...1621

Expected trading range is between...1621...to...1636..

Bearish days will be over if it can close above 1636 convincingly....

( Just my 2 cent opinion )

DISCLAIMER:This is a personal weblog of a trader.All information provided here,including recommendations(if any) should be treated for reading purposes only.All the trades mentioned are the trader's own opinion only.This blog is not responsible for your gains nor does it share your losses.YOU TRADE AT YOUR OWN RISKS.YOUR ACTIONS IS YOUR FULL RESPONSIBILITY. For those interested to subscribe: My email is : dsmyoung2011@gmail.com... https://www.facebook.com/alan.young.7330763

Sunday, 24 February 2013

Thursday, 21 February 2013

Tuesday, 19 February 2013

Analysis of FBMKLCI ( The way I look at it )

FBMKLCI

The CI is still very bearish-four consecutive red candlesticks in a row..

Stay clear of index linked counters for the time being ( for traders ).

Looks like the CI is heading towards 1600 soon..

Should it breaks this,the next support will be at 1590...

Excute only short trades for the time being...( fast in fast out..to capture profits )

Trade with care..

FBMKLCI

The CI is still very bearish-four consecutive red candlesticks in a row..

Stay clear of index linked counters for the time being ( for traders ).

Looks like the CI is heading towards 1600 soon..

Should it breaks this,the next support will be at 1590...

Excute only short trades for the time being...( fast in fast out..to capture profits )

Trade with care..

Monday, 11 February 2013

Friday, 8 February 2013

Sunday, 3 February 2013

Reading Stock Charts

Reading charts is an art form that can take years to fully master.

Why do we read charts?

Because,by reading charts,we can determine what the "big money" is doing!

You have to be able to analyze a chart and come to a conclusion about whether or not

to risk your hard earned money on a trade.That is really the bottom line.

And this is what separates the novice trader from the professional.

There are several factors on a chart that make it worthy of trading.

By analyzing these factors,we can determine with high probability which direction a stock

will move.

WISE WORDS from :

Dr.Alexander Elder

A good signal jumps at you from the chart and grabs you by the face-you cant miss it!

It pays to wait for such signals instead of forcing trades when the market offers you none.

Amateurs look for challenges;

Professionals look for easy trades.

Losers get high from the action;

The Pros look for the best odds.

William J. O`Neil

History repeats itself in the stock market.

Many price patterns and price consolidation structures that stocks form are repeated

over and over again.

Edwin Lefevre

If a stock doesnt act right dont touch it;because being unable to tell precisely what is

wrong you cannot tell which way it is going.

No diagnosis,no prognosis.

No prognosis,no profit

Linda Bradford Raschke

Some of the best trades come when everyone gets very panicky.The crowd can often act

very stupidly in the markets.You can picture price fluctuations around an equilibrium level

as a rubber band being stretched- if it gets pulled too far,eventually it will snap back.

As a short-term trader,I try to wait until the rubber band is stretched to its extreme point.

Reading charts is an art form that can take years to fully master.

Why do we read charts?

Because,by reading charts,we can determine what the "big money" is doing!

You have to be able to analyze a chart and come to a conclusion about whether or not

to risk your hard earned money on a trade.That is really the bottom line.

And this is what separates the novice trader from the professional.

There are several factors on a chart that make it worthy of trading.

By analyzing these factors,we can determine with high probability which direction a stock

will move.

WISE WORDS from :

Dr.Alexander Elder

A good signal jumps at you from the chart and grabs you by the face-you cant miss it!

It pays to wait for such signals instead of forcing trades when the market offers you none.

Amateurs look for challenges;

Professionals look for easy trades.

Losers get high from the action;

The Pros look for the best odds.

William J. O`Neil

History repeats itself in the stock market.

Many price patterns and price consolidation structures that stocks form are repeated

over and over again.

Edwin Lefevre

If a stock doesnt act right dont touch it;because being unable to tell precisely what is

wrong you cannot tell which way it is going.

No diagnosis,no prognosis.

No prognosis,no profit

Linda Bradford Raschke

Some of the best trades come when everyone gets very panicky.The crowd can often act

very stupidly in the markets.You can picture price fluctuations around an equilibrium level

as a rubber band being stretched- if it gets pulled too far,eventually it will snap back.

As a short-term trader,I try to wait until the rubber band is stretched to its extreme point.

Friday, 1 February 2013

Takeover Offer

Now that the cat is out of the bag,I dont mind telling you the counter I collected

on last Friday is MISC at 4.30.

Petronas has proposes to take MISC private at offer price of 5.30 per share.

The offer price represents an 85 cents per share premium over the last traded

at Rm 4.45 before suspension at 12.28pm on Thursday.

( Most of my private members got it at 4.30.Together we.... Fatt!!!

Those interested to joint me...pls email me at....dsmyoung2011@gmail.com )

Now that the cat is out of the bag,I dont mind telling you the counter I collected

on last Friday is MISC at 4.30.

Petronas has proposes to take MISC private at offer price of 5.30 per share.

The offer price represents an 85 cents per share premium over the last traded

at Rm 4.45 before suspension at 12.28pm on Thursday.

( Most of my private members got it at 4.30.Together we.... Fatt!!!

Those interested to joint me...pls email me at....dsmyoung2011@gmail.com )

MY PRIVATE MEMBERS

A very big "Thank You" to all of you.

You have make the right decision to join me.

My "GOAL" is to turn Mr. Market into a "ATM" cash machine for all my members.

The "Money " is on the table to take...but there is a catch,Mr. Market only give it

to those who knows the way........

( For just a token sum...my daily coffee treats,you get back many Starbucks coffee

in return...)

What is Leverage ???

1) Share margin finance

The bank lends you money to buy more shares in the market.In return the bank

charges very low interest rate.It is a two edged sword.You can double your profits

and you can also loses your pants.Only use this facility in a bull market.

2) Tips from Remiser

Dont ask tips from your remiser.Ask him for the name of the customer who wins

most of the time."Leverage" on this person`s experiences.

3) For businesses

Before launching a new product,most companies will make sure their existing Brand

is well established in the market.Leverage on this,they will be able to build on their

distribution networks and good rapport with their customers.

A very big "Thank You" to all of you.

You have make the right decision to join me.

My "GOAL" is to turn Mr. Market into a "ATM" cash machine for all my members.

The "Money " is on the table to take...but there is a catch,Mr. Market only give it

to those who knows the way........

( For just a token sum...my daily coffee treats,you get back many Starbucks coffee

in return...)

What is Leverage ???

1) Share margin finance

The bank lends you money to buy more shares in the market.In return the bank

charges very low interest rate.It is a two edged sword.You can double your profits

and you can also loses your pants.Only use this facility in a bull market.

2) Tips from Remiser

Dont ask tips from your remiser.Ask him for the name of the customer who wins

most of the time."Leverage" on this person`s experiences.

3) For businesses

Before launching a new product,most companies will make sure their existing Brand

is well established in the market.Leverage on this,they will be able to build on their

distribution networks and good rapport with their customers.

Subscribe to:

Comments (Atom)