MAKES YOUR MONEY WORK FOR U

DISCLAIMER:This is a personal weblog of a trader.All information provided here,including recommendations(if any) should be treated for reading purposes only.All the trades mentioned are the trader's own opinion only.This blog is not responsible for your gains nor does it share your losses.YOU TRADE AT YOUR OWN RISKS.YOUR ACTIONS IS YOUR FULL RESPONSIBILITY. For those interested to subscribe: My email is : dsmyoung2011@gmail.com... https://www.facebook.com/alan.young.7330763

Saturday 5 May 2018

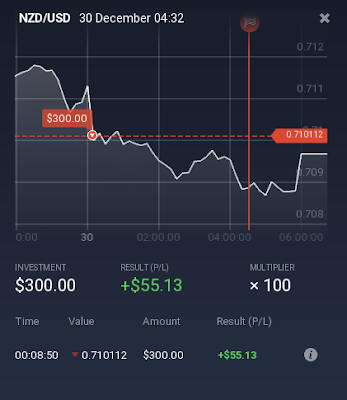

Saturday 30 December 2017

Wednesday 27 December 2017

Thursday 21 December 2017

Wednesday 20 December 2017

Thursday 14 December 2017

Saturday 9 December 2017

Subscribe to:

Posts (Atom)