For profitable contra trades ,a good money management strategy,cut loss policy and when to buy and sell is

a must.Lets say you have a working capital of 100,000 (or credit facility),how do you maximise your profits

and minimise your risks.Spread your risks by dividing your capital by five if you are trading five counters....

Example:

1) First counter you make 5%

2) Second counter you lose 3%

3) Third counter you lose 2%

4) Fourth counter you make 4%

5) Fifth counter you make 5%

Nett gain is 9%

20,000( 100,000/5 counters) x 9% gives you 1,800

1,800 x 3 =5,400/per mth (12 to 16 contra trades are done per month.)

For those with working capital of 20,000/30,000/50,000/150,000/200,000 ,please allocate the money accordingly( per counter).

P/S......The above is just a hypothetical example...

Hope the above is helpful to my *Contra Trade Member's Group*.

The above is just *My Trade Plan*.If you have a better plan that gives you good profits,stick to it.

My *December contra trades* will be revised to the above format.

a must.Lets say you have a working capital of 100,000 (or credit facility),how do you maximise your profits

and minimise your risks.Spread your risks by dividing your capital by five if you are trading five counters....

Example:

1) First counter you make 5%

2) Second counter you lose 3%

3) Third counter you lose 2%

4) Fourth counter you make 4%

5) Fifth counter you make 5%

Nett gain is 9%

20,000( 100,000/5 counters) x 9% gives you 1,800

1,800 x 3 =5,400/per mth (12 to 16 contra trades are done per month.)

For those with working capital of 20,000/30,000/50,000/150,000/200,000 ,please allocate the money accordingly( per counter).

P/S......The above is just a hypothetical example...

Hope the above is helpful to my *Contra Trade Member's Group*.

The above is just *My Trade Plan*.If you have a better plan that gives you good profits,stick to it.

My *December contra trades* will be revised to the above format.

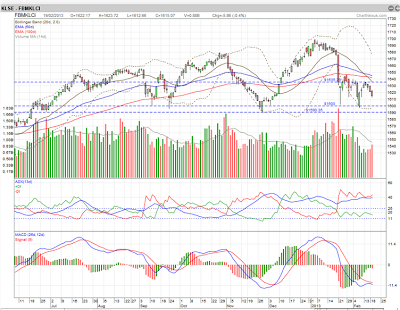

Stock market stages occur in all time frames on every chart you look

at. This could be a five minute chart of Microsoft or a weekly chart of

the Dow.

Stock market stages occur in all time frames on every chart you look

at. This could be a five minute chart of Microsoft or a weekly chart of

the Dow.